Applying/Handling a Credit

Here's some tips on how you can apply/handle a credit in Smartcare:

- Discount - The simplest way of handling a credit is to apply a discount to the current (or future) invoice for the client.

1) Go to the Client's profile (Menu > Clients > Client Management > Click their profile picture) and go to the Invoicing section.

2) Select the billing period that you would like to apply this discount/credit to and create an entry under the Discount section. It is recommended to add the date that the credit is stemming from for documentation purposes. ***If this is for a future invoice and the billing period has not yet been created, you may have to wait until your agency begins the billing process for this billing period***

3) On the invoice, you will see that the Current Invoice total remain the same to fully reflect the amount of fees accrued for this billing period. However, the discount will be reflected in how much the client owes for this billing period.

- Balancing Negative Invoice Balance (Reduction in Fees Owed)

Refund - This can be used if you are intending to give this money back directly to the client if they have a negative invoice balance. You can also use this if you are wanting to balance out a negative invoice balance on a client's account, while still applying the credit to another billing period. (In other words, this would be an additional step needed if you are applying a credit to an invoice from the steps listed above and also are balancing out the negative balance for a client.)

In the image below, we see via Payer Invoicing that the client has a negative balance. In this example, the negative balance is due to a reduction in fees owed (from changes made on the scheduling dashboard) after payment was made.

1) Go to the Client's profile (Menu > Clients > Client Management > Click their profile picture) and go to the Invoicing section (see image in 1st step above).

2) Select the billing period that the client has the negative balance for. Create an entry for a Refund for this billing period for the same amount as the negative balance on their account.

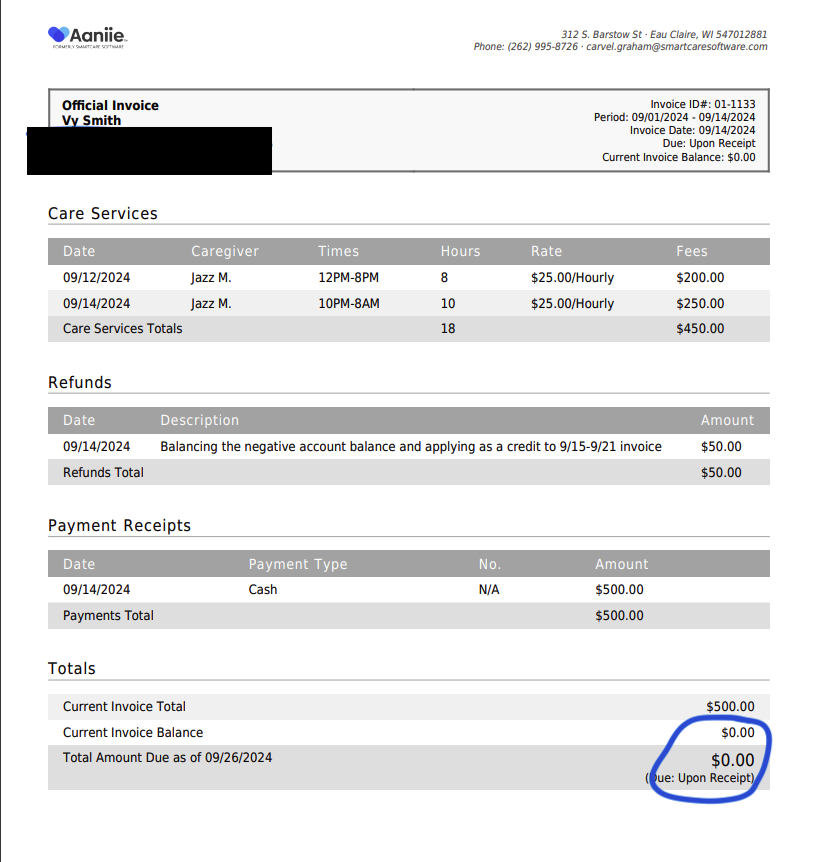

3) Go to the Payer Invoicing and regenerate the invoice for this client. You will now see that the balance should be at zero. Below is how the invoice will now look:

4) Now that the account is at 0, if you wish to apply the credit to an invoice, see the steps above for applying the credit.

- Balancing a Negative Account Balance (Overpayment from client):

When a customer has issued overpayment and this has been reflected in a receipt for a billing period, you can simply apply this credit to the next billing period by editing the receipt.

In the image below, we see via Manage Receipts in Payer Invoicing, that the accountant for this site has created a receipt for payment from client Vy Smith. In this situation, Smith has written a check in which she has paid in excess of $100.

In Payer invoicing, we see the Invoice Balance has been zeroed, but there is now a negative account balance for Smith, which reflects the credit from overpayment:

To apply this credit, in Payer Invoicing go to the current billing period and go to Manage Receipts. Once here, 'x' out the Invoice ID, select 'Only receipts with credit' and then hit the magnifying glass icon to search. After doing this, find the receipt with the credit from the previous invoice and click the edit receipt pencil icon.

Next, you should see the payment for the previous invoice and a line to add an amount to the current invoice. Apply the remaining credit amount to the current invoice and click save.

If the credit is less than what is owed, enter the amount of remaining credit. If the credit is more than what is owed, enter the amount owed on the invoice only.

You will now see that the invoice balance & account balance for the current billing period is showing a reduced amount from the credit being applied.

***it is recommended to add a note to the new invoice to indicate where that credit is stemming from*** (see invoice below for reference)

Once the client makes a payment for the current billing period, the negative account balance from the previous invoice will now be balanced.

Related Articles

How to Find a Credit

While handling accounting, there may be instances in which you discover a client has a credit on their account, but cannot find where/when it stems from. There are two ways to easily find the billing period that the credit exists in. Via Invoices ...Aaniie Payments - Applying a Refund to a Payment

How to apply a refund from a previously submitting payment when using Aaniie Payments. Please view the attachement for the tip sheet on this process.Client Invoicing Forms

Please see the attached document to view the Client Invoicing Forms Tip Sheet. This tip sheet shows examples of each client invoicing form and how it is displayed on the invoice PDF.Adding Convenience Fees and Surcharges

When using Aaniie Payments with credit card payments you do have the ability to have a automatic Convenience Fee or Surcharge added to the invoice. In this option you can charge your client a percentage of their bill or a fixed dollar amount when ...PCC Receipt Auto Generation

Receipts will automatically post in Smartcare towards the invoice balance when the PointClickCare send action is clicked. Steps: Navigate to the Site Settings and find your agency's PointClickCare Settings. Toggle to automatically generate receipts ...